FIXED DEPOSIT

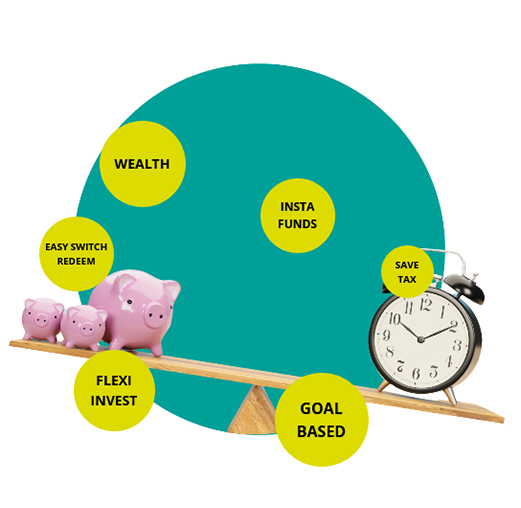

Earn Additional income and grow your corpus

We are financial consultants that help you to grow your money and earn additional interest income with minimal risk.

CONTACT US

CONTACT US