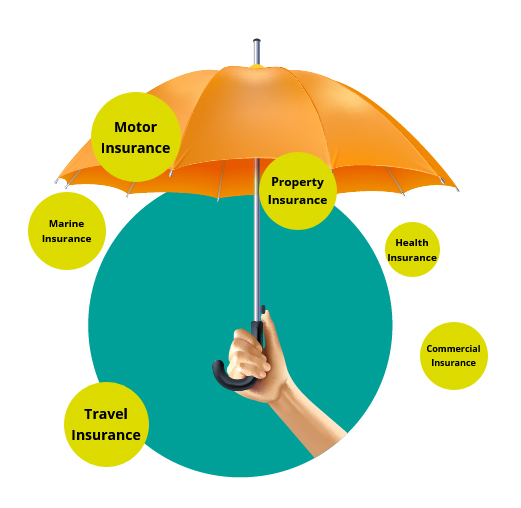

GENERAL INSURANCE

Secure your assets with reliable insurance policies

We are financial consultants that help you with protecting your assets through appropriate insurance policies, as per the risk factors involved.

CONTACT US

CONTACT US